Undercutting competition by burning unlimited amounts of investor cash is part of the business model.

Shares of rental-car conglomerate Hertz Global Holdings closed at $14.98 on Friday, after reaching an all-time low of $14.32 on Thursday. These shares have only been around since last June, when Hertz spun off its equipment leasing division. They've plunged 73% from their high last July.

Hertz will report first quarter earnings on Monday. In the fourth quarter, it lost $440 million or $5.30 a share, much worse than "expected." Expectations for Q1 are so low that it will be hard to report "worse than expected" numbers.

November 9 was its big day. Its shares plunged 52% to $17.20. Carl Icahn had been vociferously hyping and buying the shares, including 15 million shares during the plunge. He has lost money relentlessly.

That day, Hertz doused car-befuddled Wall Street analysts with a dose of reality about the auto bubble. Deprecation of its vehicles was soaring as residual values were dropping. It also cited falling rental volume and falling rental rates in the US.

In 2015, it was forced to restate earnings due to accounting "errors" going back to 2011 and announced it was being investigated by the SEC.

Hertz, which is junk-rated and has $15 billion in debt, including $9.45 billion in "vehicle debt," has a tidal wave of bond maturities coming its way that it must figure out how to refinance. Some of its deteriorating metrics have breached debt covenants, and it has been forced to negotiate with its creditors to amend the creditor agreement to avoid technical default.

Now it's "again at risk of being driven back to the negotiating table for another round of covenant revisions, according to a lender and two sellside analysts," Debtwire[1] reported, adding: "Another covenant breach could jeopardize liquidity, since the bulk of liquidity is stored in the Barclays-agented revolver, the sources noted."

So Hertz has, let's say, some issues. But there is something else going on, something structural that impacts the entire industry.

Rideshare companies such as Uber and Lyft are eating its lunch. OK, competition might not be all that fair. While Hertz gets keelhauled when it loses a few hundred millions dollars, Uber is considered a hero when it loses billions of dollars [Uber Confirms Horrendous Loss in 2016[2]].

It's easy to plow down competition when burning unlimited amounts of investor cash is part of the business model. This allows Uber to undercut any kind of competition.

Data on the extent to which rideshare companies are taking market share from rental car companies is still sketchy. But there are some early indications.

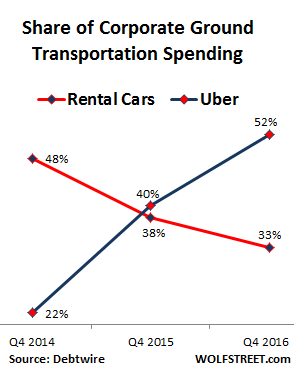

This chart shows how corporate spending on ground transportation was divvied up between rental cars (red line) and Uber (blue line) in Q4 of the past three years, according to a sellside analyst cited by Debtwire. Not shown: taxis, whose share is getting decimated.

This is largely corroborated by Manheim's 2017 Used Car Market Report[3], citing an analysis of business travel expenses by Certify SmartSpend, which pegged the market share of Uber and Lyft in Q3 2016 at 52% of ground transportation spending, up from 46% in Q3 2015. The share of rental cars dropped to 36%, and the share of taxis to 12%.

Even if these numbers – like so many numbers – are extrapolated from limited data, and to be taken with a grain of salt, they nevertheless show a terrible trend for rental car companies in that segment of their business.

This does not include spending by non-expense-account tourists. They too are shifting from rental cars to rideshare companies to get around in a city. They don't have to worry about driving and parking in an unknown city. And it could turn out to be cheaper, given the cost of renting, fuel, and parking (not to speak of parking tickets). I see this shift in San Francisco on a massive scale.

This is a structural shift. And it will get bigger. Rideshare companies are not only hammering taxi enterprises, they're also hammering rental car companies in that segment of their business.

Rental car companies are starting to respond by "rightsizing" their fleets. In 2015, they bought 1.78 million new vehicles, according to Manheim. That's about how many they have to unload this year just to maintain their fleet size. If they want to cut their fleet size, they'll have to unload more.

But in 2016, rental car companies bought 1.82 million vehicles – the most since 2007. So the fleet isn't exactly shrinking. But revenue per vehicle, a key industry metric, has been shrinking since 2012. Hence the term, "over-fleeted." Something has to give.

To shrink their fleets, they'll have to dump more vehicles on the wholesale market. But the wholesale market is already under pressure from the tsunami of cars that are coming off leases. In its recently released April Used Car Guidelines[4], the National Automobile Dealer Association reported that values of vehicles up to 8 years old fell 7.2% year-over-year to the lowest level since 2010. Note the price bubble in the years after the Financial Crisis:

It isn't going to be easy for rental car companies to rightsize their fleets without incurring large losses. And by rightsizing their fleets, they will further pressure used vehicle values. At the same time, rideshare companies, which can burn as much cash as they want to and still be heroes, are relentlessly eating into that segment.

This has ramifications for new vehicle sales: rental car companies are unlikely to increase their vehicle purchases, which could further pressure new vehicle sales. They're already declining, despite record incentives, as inventory bloat spreads to zombie retail malls. Read… #Carmageddon Not Yet, But Hot Air Hisses out of Auto Bubble[5]

References

- ^ Debtwire (www.debtwire.com)

- ^ Uber Confirms Horrendous Loss in 2016 (wolfstreet.com)

- ^ Used Car Market Report (publish.manheim.com)

- ^ April Used Car Guidelines (img03.en25.com)

- ^ #Carmageddon Not Yet, But Hot Air Hisses out of Auto Bubble (wolfstreet.com)

Source

Blog Archive

-

▼

2017

(1262)

-

▼

May

(94)

- Car Explosion Kills 6 in Mogadishu

- The Most Important Facts (And Myths) About Your Ca...

- New skateboard hooks into cable car tracks for ‘...

- Car mows down pedestrians in Times Square, New York

- Woman killed, 22 injured after car plows into pede...

- Evolution of the Car Design Revolution

- Global Exterior Car Accessories Market is Expected...

- Drawing attention to distractions w/video

- Carstairs safety fears as faulty alarm 'puts hospi...

- What it’s Really Like to Ride the World’s Most...

- United States Chinese Car Carrier Market Analysis,...

- Tesla Model S Coupe Gets Internal Combustion Engin...

- Car enthusiast seeks Lorain help in mystery of Mer...

- The revolutionary electric car battery that can be...

- Driver's miraculous escape after her car is split ...

- Are we on the verge of a car design revolution?

- Why is this free car park lying empty?

- Son, 28, spent Mother's Day with his mum - 'before...

- Bear Hit By Car; Disney Hacked; Ralphs To Hire 800...

- Jay Leno releases car restoration product line

- Car sharing brand Zipcar to enter Taipei in Q2

- New car finance deals hit record £3.6bn as consum...

- Valero car show revs up $5,226 for food bank

- The evolution of Microsoft's Connected Vehicle Pla...

- Explosion near Rome post office damages car, no in...

- Stunned woman returns to her car after a doctor's ...

- An F1 car for an alarm clock: Williams and Airbnb ...

- 2 more suspicious car fires overnight in East Bay

- Kicker DXA250.1 DX-Series 500W Mono Car Amplifier

- Answers Emerge: This is How Badly Uber Eats into H...

- Market Focus: TradeMark Car Wash awards $4,000 sch...

- U.S. used-car glut is a dealer’s dream, automake...

- Cartoon Car Spotlight: Should ‘Speed Buggy’ Be...

- Jealous girlfriend and her lover who killed his ex...

- Car Next Door: This guy makes $1000 a month doing ...

- Nurse, 25, who claimed she was trying to sleep in ...

- Brand-new Ford Fusions used to smuggle marijuana f...

- BCA Pulse reports used car prices above £9,000 fo...

- Africa: TVET Engineering Students Design Prototype...

- Rats eat through car engine, cause fire; Tony Hawk...

- The astonishing optical illusion that shows a car ...

- Theme in the 11th International Zagreb Car Cartoon...

- Somalia explosion: Car bomb rocks Mogadishu, at le...

- Global and Chinese Car Carrier Market 2017 Industr...

- How you can fight back against the insurance pirat...

- Four common reasons why UAE insurers may not cover...

- The most powerful road-legal car yet? Inventor tra...

- 4 dead after car collides with Chicago bus

- Global Remote Control for Car Alarm System Market ...

- Midknight Detailing - They detail individuals cars...

- Electric car driver finds altered BMW ad lowers ra...

- The blueprint for an icon: Ferrari 275 GTB/4 proto...

- Pregnant woman and three others die in Chicago aft...

- Global Car Dashboard Digital Video Recorder Camera...

- Missing Dogs After Car Theft Prompt Social Media C...

- So what if beacon is gone? I have the emblem

- Woman lured with car as free gift for e-shopping, ...

- Motor World Car Factory v1.8009 Mod Apk [Unlimited...

- Better Call Behnken: Disabled veteran finally back...

- Car Insurance: Be prepared for the worst

- Car Loans Bank announce new car loan options in Sa...

- This is How Uber Eats into Hertz

- The art of (almost) spinning out of control

- Exclusive: India's green car plan prioritizes elec...

- Police: Car driver ran red light in Vegas school b...

- How To Revive A Dead Car Battery With Aspirin Or E...

- From 'write-off' to revved-up, flood-damaged car f...

- Tampa Bay Buccaneers release statement on Doug Mar...

- Kent Magic Car Air Purifier Review

- Popular stroller-car seat combo recalled

- Global USB Car Charger Sales Market Report 2016 It...

- Las Vegas school bus crash leaves 16 students hurt...

- Wrecked Car, Body Found In Creek Near Vera

- Cartoon †Ouch Potato: Commuting by car

- Professional Market Analysis: Global Car Care Prod...

- BMW says has made adequate provisions for fall in ...

- Jardine Cycle & Carriage : JC&C 2017 First Quarter...

- Why You're Wrong About What Engine You Want For Yo...

- 3 dead, 6 remain hospitalized from apparent accide...

- Black lawmakers to protest over Confederate emblem...

- Man tries swallowing crack after crashing into par...

- Syracuse crash victim, still in hospital, thanks m...

- BCA Partner Finance launches part-exchange funding

- Toddler locks himself inside car, laughs as 5 fire...

- Scott family attorney: Slager conviction a 'bluepr...

- Electric Car Test Drives at Wellington Show

- VicoVation Vico-Opia 2 Premium Pack Car Camcorder ...

- Ending tax credits would kill electric-car market,...

- Mercedes E200 Long-Term Test: Hand on heart, our c...

- BMW designed a car without any mirrors

- Hella Vegan Eats Keeps It Oakland With Animal-Free...

- The Car Guy on your car and its needs

- Kicker DXA250.4 DX-Series 4 x 120W Car Amplifier

- Tesla electric car battery life, Toyota fuel-cell ...

-

▼

May

(94)

Total Pageviews

Search This Blog

Popular Posts

-

Video mobil cars 2, video mobil cars anak anak, gambar kartun mobil cars, gambar mobil cars yg belum diwarnai, gambar mewarnai mobil cars, v...

-

Supplement Murah Mampu Milik Untuk Kucing Hidayat's Petblog via hidayatmy.blogspot.com Sakit Telinga? Ini Dia Ubatnya. - Petua ...

-

Foto mobil murah buatan indonesia yang, foto mobil murah buatan manusia, foto mobil murah buatan indonesia, foto mobil murah buatan orang, f...